For life

Mortgages

We search the mortgage market so you don't have to

Speak to our For Life team

We can offer a true ‘one stop’ service when it comes to buying, selling or remortgaging a property.

We can provide mortgage advice and arrange finance that is most suitable for you. As we are not tied to any particular Bank or Building Society our advice is independent and will be based upon mortgage products from all lenders in the intermediary market.

Karen Crombie explains the different types of mortgages available in this YouTube video.

Following a detailed review of your circumstances, we can recommend the most appropriate mortgage solution for you.

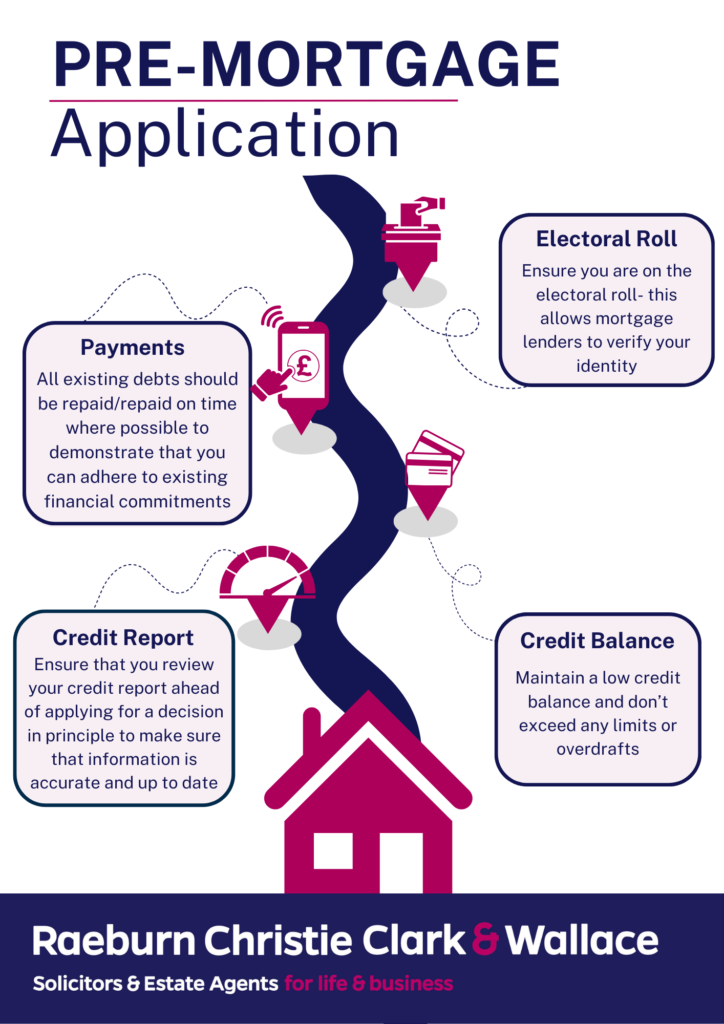

You may find the following pre-mortgage application checklist useful:

We have a team of experienced mortgage advisors covering all our branch offices and can arrange an appointment at any of these locations to suit you.