Media

LBTT and what it means for you

LBTT

Establishing what you can afford when buying a home involves more than just working out the deposit on your property and the monthly mortgage payments. There are additional costs to be considered that will affect the home purchasing process including LBTT (Land and Buildings Transaction Tax).

LBTT replaced what was known as ‘Stamp duty land tax’ and is applied to both residential and commercial land and buildings transactions.

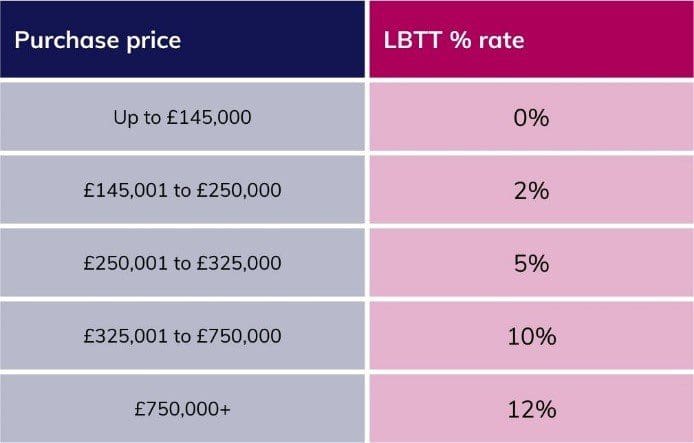

Depending on the price of the property, LBTT is charged accordingly and increases per price bracket and is only applicable when the property is above a certain value. Once the value reaches £145,000, LBTT rates apply as shown below.

LBTT Bands and Rates

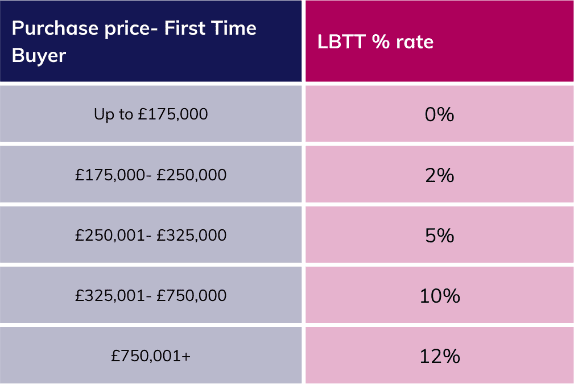

For many first time buyers, they benefit from additional LBTT exemptions when they purchase a property below £175,000. The remainder of the tax calculation is a tiered calculation, as shown below.

In order to qualify for this tax exemption, the following criteria need to be met:

- The purchaser must not have held any interest in any property anywhere in the world.

- In case of a couple purchasing together, both must be first time buyers in order to benefit.

- The property being purchased must also be the purchaser’s main residence.

First Time Buyer LBTT Bands Rates

When there are any changes to LBTT rates, these are announced as part of the yearly budget in Scotland and are approved by the Scottish parliament.